Stablecoin Economy Continues to Shrink Shedding Close to 5% in 2 Months – Altcoins Bitcoin News

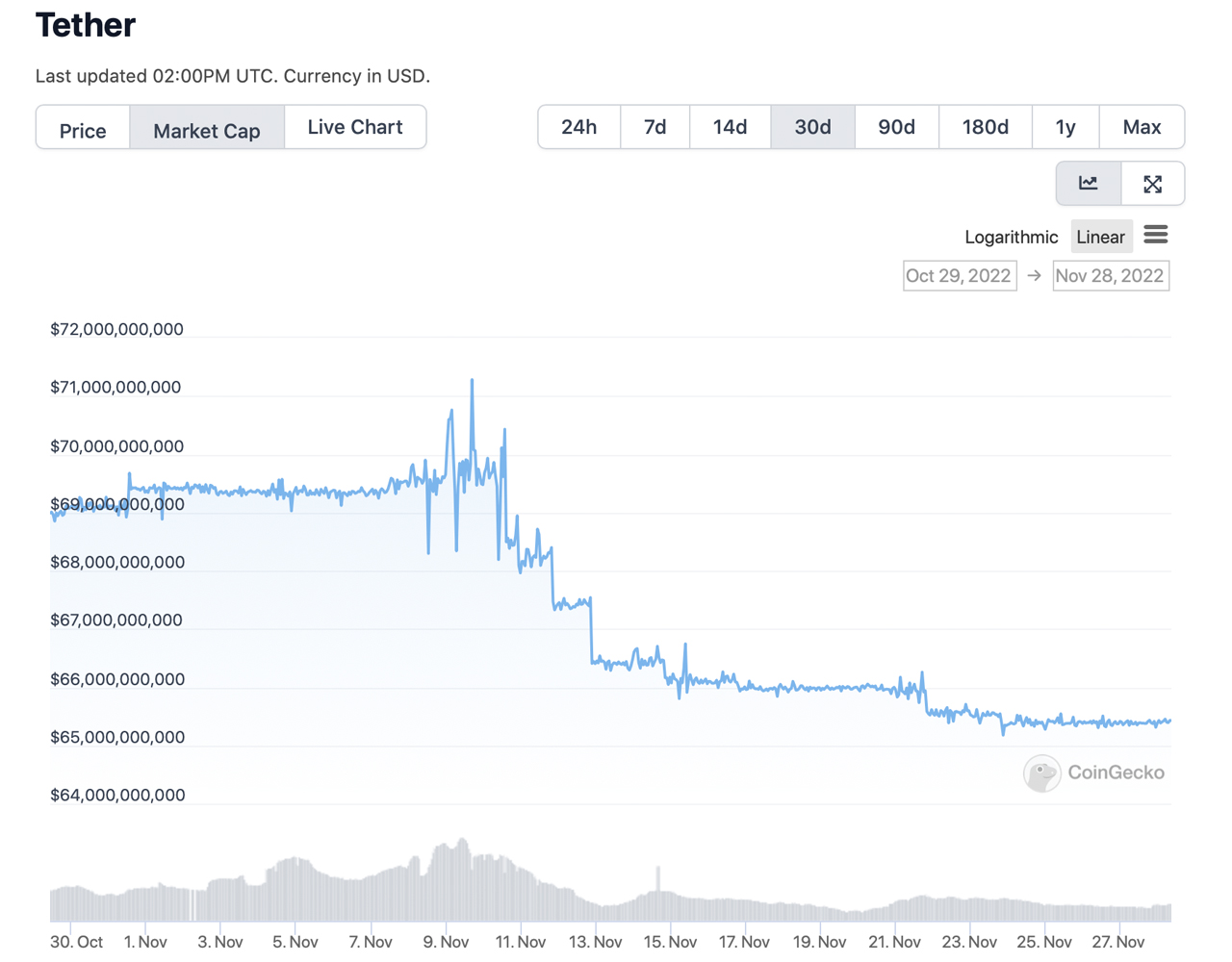

During the last month, the market capitalization of all the stablecoins in existence dropped by more than 2%, shedding roughly $2.98 billion since the end of October. Statistics show that tether, the largest stablecoin by market valuation, saw its market cap lose more than 5% during the last 30 days. Tether’s market cap slipped from last month’s $69.13 billion to today’s $65.48 billion.

Stablecoin Economy Drops Lower, Tether Market Cap Sheds 5%

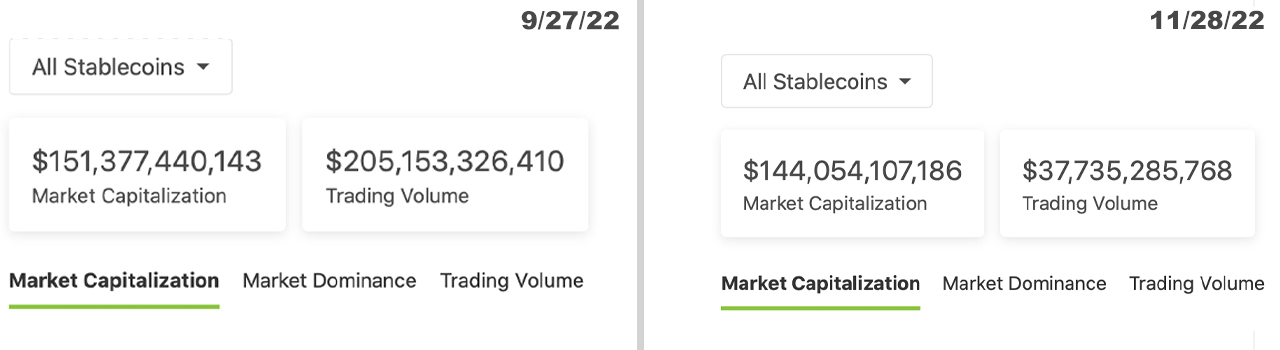

Statistics show that the stablecoin economy’s market valuation has reduced during the last 30 days by roughly 2.02%. On Oct. 31, 2022, the stablecoin economy was valued at $147.03 billion and today, it’s down to $144.05 billion.

Furthermore, the market capitalization of all the stablecoins in existence is much lower than it was two months ago, as the market cap dropped by 4.83% from $151.37 billion to today’s $144 billion total. Data indicates that this past month, tether (USDT) has seen its market capitalization drop more than 5% lower from $69.13 billion to the current $65.48 billion.

However, the second-largest stablecoin by market cap, usd coin (USDC) has seen its market valuation increase during the past 30 days, jumping roughly 1.5% higher. The stablecoin BUSD’s valuation continues to grow month after month, and over the last 30 days, it’s up 4.8%. Out of the top five stablecoins today, BUSD’s market cap grew the most over the last month.

Makerdao’s DAI stablecoin has shed 9.7% this past month and the stablecoin’s market capitalization was the biggest loser out of the top ten dollar-pegged crypto tokens. On Oct. 31, DAI’s market cap was around $5.77 billion and today, it’s coasting along at $5.20 billion. With tether and DAI leading the losses over the last month out of the top ten stablecoins, frax (FRAX) followed behind the two tokens shedding around 3.1% last month.

Stablecoin trade volume has dropped a great deal over the last two months but the tokens still represent a majority of today’s trades. For instance, on Sept. 27, 2022, stablecoins captured $205 billion out of the $225 billion in global trades. On Oct. 31, stablecoins recorded $55.91 billion in trades out of the total worldwide crypto trade volume ($71 billion).

During the past 24 hours stablecoins have captured $37.73 billion and the aggregate trade volume among all the crypto coins in existence today is roughly $46.56 billion. This means out of the $46 billion in trades among all the crypto assets, stablecoins equate to 81.04% of those trades.

What do you think about the state of the stablecoin market today? What do you think about the stablecoin economy’s valuation slipping by close to 5% during the past two months? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.