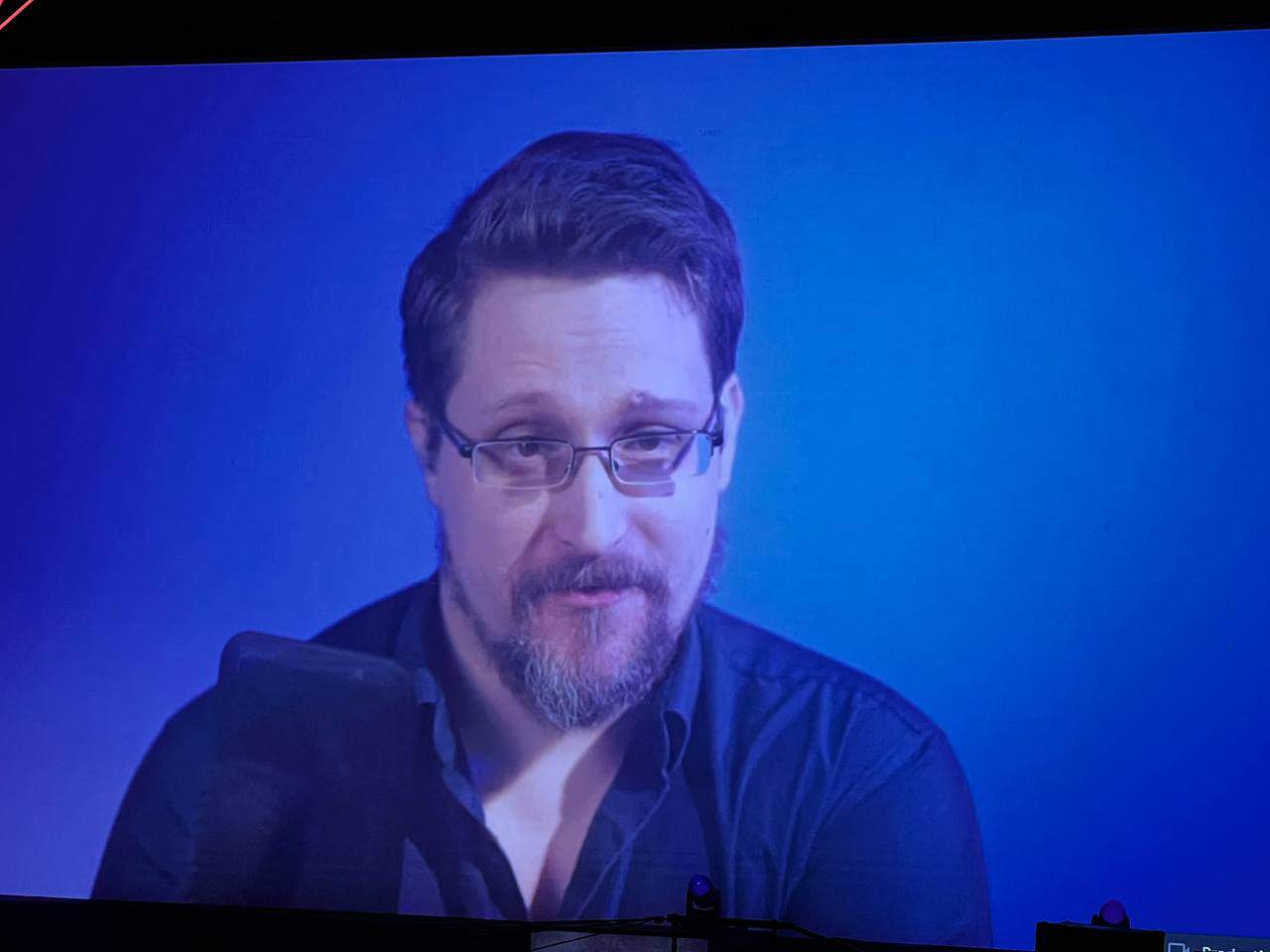

Edward Snowden Believes Bitcoin ETFs Are Taming BTC (Bitcoin Amsterdam LIVE)

While speaking at the BTC Conference, Edward Snowden, who has been supportive of the cryptocurrency for years, said people should avert from thinking mostly about the price of the asset.

He also talked about the potential risks of institutions getting involved with the industry, especially BTC exchange-traded funds.

Snowden advised BTC investors who are focusing on the asset’s price movements to locate the actual use cases of the cryptocurrency instead of looking at charts and candles.

He believes bitcoin has a problem with the lack of real anonymity, which makes it easy for governments to track the people behind certain transactions. He compared this to the way he leaked classified NSA documents back in 2013 and used BTC to pay for the servers he used.

Additionally, Snowden asserted that institutions getting into bitcoin carry certain risks. While the money being poured into the asset could push the prices higher, he warned that they will have too much power and regular people will not be able to influence their decisions and actions in regard to bitcoin.

On the same matter, he noted that Bitcoin ETFs, which are getting increasingly popular, especially with the big financial firms filing applications to launch such products, are actually “taming” BTC.

He also spoke about government and regulatory agencies trying to have their say on how to oversee bitcoin and the entire industry and asserted that he doesn’t care about what Gary Gensler (the SEC Chair) thinks, nor should BTC users and investors.

Lastly, Snowden advised developers and regular users to focus more on making BTC more anonymous, which would actually help it fulfill Satoshi Nakamoto’s vision.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO50 code to receive up to $7,000 on your deposits.