AI tokens FET, AGIX, OCEAN, and ARKM surge despite market sell-off

Share this article

A number of artificial intelligence (AI)-related crypto assets have shown an impressive performance despite Monday’s market sell-off. These include Fetch.ai (FET), Ocean Protocol (OCEAN), SingularityNET (AGIX), and Arkham (ARKM).

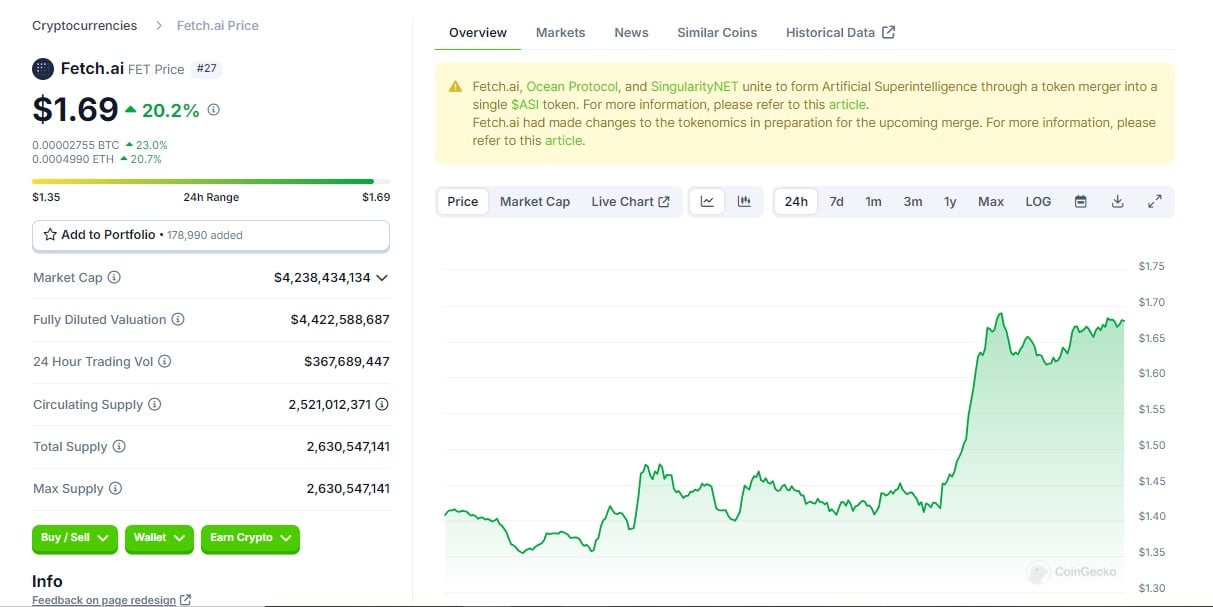

According to data from CoinGecko, FET has seen a 20% increase over the past 24 hours, with its current price at $1.69.

OCEAN has also shown a positive trend with a 24-hour increase of 15%, and its current price is $0.68. Meanwhile, AGIX has been up around 15.5% in the last 24 hours, currently trading at around $0.68.

The recent price surge follows news from the Artificial Superintelligence Alliance, including SingularityNET, Fetch.ai, and Ocean Protocol, that it will initiate the ASI token merger on July 1. Earlier this month, the alliance said it would postpone the merger to July 15.

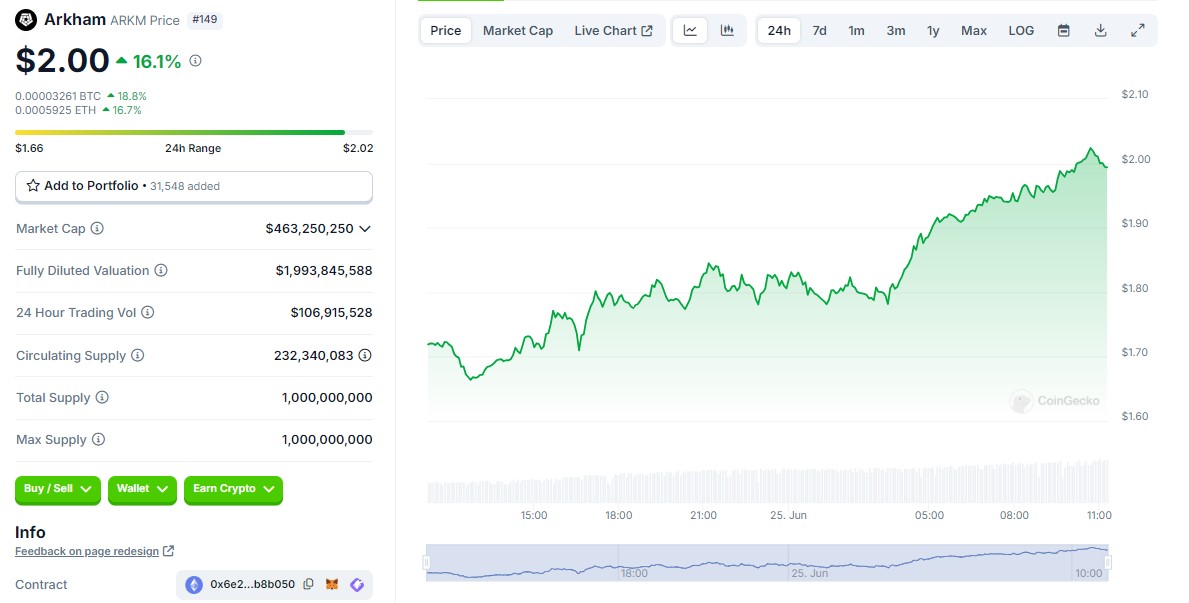

Another mainstream AI token, ARKM, the native token of the Arkham platform, an AI-driven blockchain analytics platform, has also experienced a 16% surge over the past 24 hours. Currently, ARKM is trading at around $2.

The surge in AI tokens comes amid a market correction early Monday after the defunct crypto exchange Mt. Gox announced plans to repay its creditors $9 billion in July.

In the past, news surrounding Mt. Gox triggered a market sell-off. For instance, last month, Bitcoin’s price experienced a minor dip, dropping from $70,000 to $68,500 after Arkham’s data showed that a wallet associated with Mt. Gox started transferring over 140,000 BTC, worth roughly $9 billion to a new wallet, a move considered a preparatory step for creditor repayments.

Bitcoin’s price dropped below $59,000 after the latest announcement. At press time, BTC had recovered to over $61,000, but it was still down over 2% in the past 24 hours. The flagship crypto asset has been down almost 11% this month.

Share this article